ONLINE ASSET REGISTER

What is a fixed asset register?

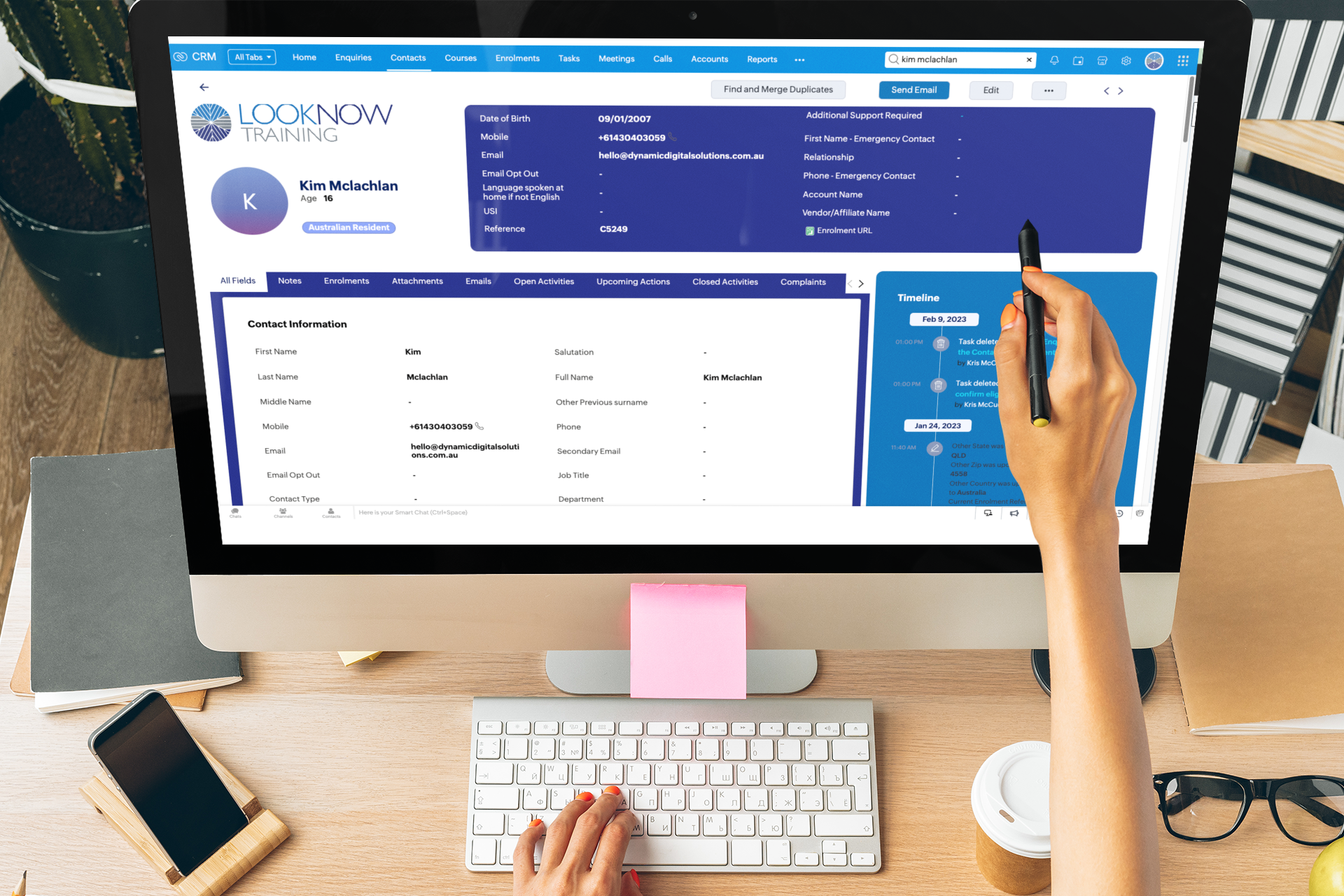

Dynamic Digital Solutions has been a Zoho Partner for 5 years, creating fixed asset registers in Zoho CRM or Zoho Creator, depending on the clients’ unique circumstances.

Let us help you manage the life time value and cost associated with each asset including your maintenance and insurance needs.

Keep track of important assets

Online Asset Registers can be used to keep track of important assets including the ongoing maintenance costs associated with these assets.

Asset registers enable you to keep track of important assets like:

- motor vehicles

- plant and equipment

- inventory

- other

Analyse maintenances needs

Online asset registers provide a way to track associated maintenance, insurance and depreciations costs. Some accounting systems will include asset registers and others don’t.

This will enable you to make better procurement decisions and to control the maintenance costs associated with these assets.